GTL Infra Share Price Target from 2024 to 2080 : When it comes to GTL Infrastructure Limited, investors often wonder about the future trajectory of its share price. A major player in the telecom infrastructure sector, GTL Infra has seen its fair share of ups and downs. From supporting phone companies with towers and equipment to dealing with the challenges of past scandals, here is a detailed look at what GTL Infra’s share price could look like in the coming decades.

What is GTL Infra?

GTL Infrastructure Limited is an integral part of India’s telecom landscape, providing and managing space for telecom companies to place their equipment. With over 26,000 towers across the country, GTL Infra is a leading force in telecom infrastructure. They facilitate telecom operations by providing space for equipment and ensuring power supply to these towers.

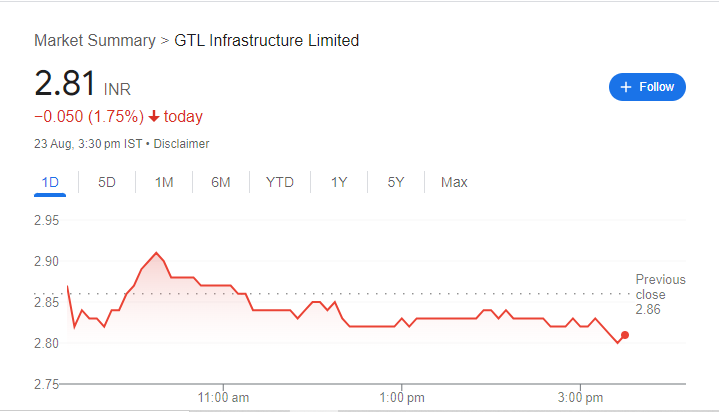

Current Market Overview

GTL Infra Share Price Today Track the latest market trends and GTL Infra’s share performance on platforms like Trading View.

Factors Influencing GTL Infra Share Price

Several key drivers impact the share price of GTL Infrastructure Ltd. Here’s a breakdown of what shapes GTL Infra’s market performance:

Economic Indicators

Economic conditions, both global and domestic, play a significant role in determining GTL Infra’s stock price. Key indicators include:

- GDP growth: High economic growth often drives demand for telecommunications infrastructure as businesses expand and consumer spending increases.

- Business production: Increased production activities may drive the need for more communications networks and infrastructure.

- Infrastructure spending: Government and private sector investments in infrastructure may have a positive impact on GTL’s market opportunities.

Government Policies

Government regulation and budget allocations are important factors:

- Telecommunications infrastructure development: Policies and investments aimed at improving telecommunications infrastructure may create growth opportunities for GTL Infra.

- Economic reforms: Macroeconomic reforms that support infrastructure development and sustainable finance also affect GTL’s market environment.

Interest Rates

Interest rate fluctuations directly affect GTL Infra’s financial health:

- Cost of Capital: Higher interest rates can increase the cost of borrowing, thereby affecting GTL’s financial stability and profitability.

- Investment Decisions: Changes in interest rates affect investor sentiment and can impact the attractiveness of GTL’s stock.

Technological Innovations

Technological advancements can have a significant impact on:

- Telecommunications Technology: Innovations in telecommunications technology enhance service quality and operational efficiency, which can potentially increase GTL’s profitability.

- Data Analytics: Improved data analytics capabilities can optimize operations and help make better decisions.

Market Competition

The competitive landscape in the telecommunications infrastructure sector affects GTL Infra through:

- Market Share: Competition affects GTL’s market share and pricing strategies.

- Differentiation: GTL’s ability to differentiate itself through innovative solutions, superior customer service, and strategic partnerships is critical to maintaining a competitive edge.

GTL Infra’s Strategic Initiatives

To achieve the projected growth and strengthen its market position, GTL Infra is focusing on several strategic areas:

Portfolio Diversification

GTL Infra is expanding into newer areas to capture high-margin opportunities:

- Data Centers: Investing in data center infrastructure to diversify revenue streams.

- Smart City Projects: Getting involved in smart city initiatives integrating advanced technologies.

- Green Energy: Exploring opportunities in green energy projects to align with sustainability goals.

Operational Efficiency

Improving operational efficiency is a key priority:

- Risk Management: Adopting advanced risk management practices to mitigate operational risks.

- Lean Operations: Implementing lean management techniques to streamline processes and reduce costs.

- Digital Tools: Leveraging digital tools and technologies to enhance overall performance.

Focus on Sustainability

GTL Infra is committed to sustainable practices:

- Green Certification: Comply with environmental certifications and integrate green practices in operations.

- Regulatory Compliance: Meet regulatory requirements related to sustainability and environmental impact.

Financial Prudence

Maintaining a healthy balance sheet is essential:

- Debt Management: Optimizing debt levels to ensure financial sustainability.

- Asset Quality: Enhancing the quality of assets and ensuring timely project completion.

- Cash Flow: Improving cash flow through effective financial management.

Technological Investments

Investing in technology is important for GTL Infra:

- Modern Telecom Technology: Upgrading to the latest telecom technologies to remain competitive.

- Automation: Implementing automation to increase efficiency and reduce operational costs.

- Data Analytics: Using data analytics to drive strategic decision making and drive operational improvements.

Investor Breakdown and Ratios

Understanding the investor composition is important for assessing market dynamics:

- Retail and Others: 75.03%

- Promoters: 14.29%

- Other Domestic Institutions: 10.26%

- Foreign Institutions: 0.42%

This breakdown provides insight into the types of investors holding GTL Infra shares and their respective influence on the company’s stock performance.

GTL Infra Share Price Target for 2024

Looking ahead to 2024, the future for GTL Infra appears mixed. The company’s past struggles, especially after the 2G scandal when many of its towers were left unused, have cast a long shadow. Despite this, a rebound is expected with the growth of the telecom sector. Forecasts suggest that the stock price could range from ₹2.15 to ₹5.22.

| Month | Projected Range (₹) |

|---|---|

| January | ₹1.27 – ₹1.79 |

| February | ₹1.85 – ₹2.66 |

| March | ₹1.46 – ₹2.21 |

| April | ₹1.14 – ₹1.95 |

| May | ₹1.24 – ₹1.92 |

| June | ₹1.20 – ₹2.70 |

| July | ₹1.21 – ₹3.80 |

| August | ₹1.23 – ₹3.93 |

| September | ₹0.35 – ₹4.97 |

| October | ₹1.30 – ₹4.05 |

| November | ₹1.31 – ₹5.08 |

| December | ₹1.32 – ₹5.10 |

GTL Infra Share Price Target for 2025

By 2025, GTL Infra may see some positive changes, especially with the rollout of 5G services. This new technology requires better infrastructure, which GTL Infra may benefit from. If they manage to take advantage of this opportunity, the stock price may rise to between ₹3.50 and ₹9.10.

Here’s a table with the monthly projections for 2025:

| Month | Projected Range (₹) |

|---|---|

| January | ₹1.38 – ₹5.13 |

| February | ₹1.42 – ₹6.21 |

| March | ₹1.56 – ₹6.25 |

| April | ₹1.64 – ₹7.33 |

| May | ₹1.70 – ₹7.35 |

| June | ₹1.94 – ₹8.40 |

| July | ₹2.21 – ₹8.49 |

| August | ₹2.48 – ₹8.51 |

| September | ₹2.67 – ₹8.57 |

| October | ₹2.64 – ₹8.65 |

| November | ₹2.72 – ₹8.63 |

| December | ₹1.78 – ₹9.10 |

GTL Infra Share Price Target for 2030

Looking ahead to 2030, GTL Infra’s future will largely depend on how the company adapts to new advancements such as 5G. If they secure significant contracts and manage their infrastructure effectively, the stock price could potentially climb to between ₹17 and ₹43.30.

Here’s a table with the monthly projections for 2030:

| Month | Projected Range (₹) |

|---|---|

| January | ₹17 – ₹32.5 |

| February | ₹17.5 – ₹33.2 |

| March | ₹18.3 – ₹35.6 |

| April | ₹19.8 – ₹36.4 |

| May | ₹20.4 – ₹38.5 |

| June | ₹21.4 – ₹37.8 |

| July | ₹20.8 – ₹36.4 |

| August | ₹23.4 – ₹37.5 |

| September | ₹24.6 – ₹39.4 |

| October | ₹35.7 – ₹41.5 |

| November | ₹24.9 – ₹42.2 |

| December | ₹25.2 – ₹43.30 |

GTL Infra Share Price Target for 2040

By 2040, GTL Infra’s performance will be impacted by emerging technologies like 6G. If the company resolves its debt issues and positions itself well for future technology, the stock price could be in the range of ₹27 to ₹39.

Here’s a table with the monthly projections for 2040:

| Month | Projected Range (₹) |

|---|---|

| January | ₹27.38 – ₹35.13 |

| February | ₹28.42 – ₹36.21 |

| March | ₹29.56 – ₹36.25 |

| April | ₹31.64 – ₹37.33 |

| May | ₹31.70 – ₹37.35 |

| June | ₹31.94 – ₹38.40 |

| July | ₹32.21 – ₹38.49 |

| August | ₹32.48 – ₹38.51 |

| September | ₹32.67 – ₹38.57 |

| October | ₹32.64 – ₹38.65 |

| November | ₹32.72 – ₹38.63 |

| December | ₹31.78 – ₹39.00 |

GTL Infra Share Price Target for 2050

Looking further ahead to 2050, GTPL Infra may benefit from the expansion of its logistics network. However, given its stable financials, investing in the company may be risky. The stock price may range from ₹38 to ₹50.

Here’s a table with the monthly projections for 2050:

| Month | Projected Range (₹) |

|---|---|

| January | ₹38 – ₹41.5 |

| February | ₹39 – ₹40.7 |

| March | ₹40.5 – ₹44.8 |

| April | ₹41.2 – ₹45.3 |

| May | ₹40.7 – ₹43.8 |

| June | ₹42.5 – ₹47.5 |

| July | ₹45.3 – ₹49.8 |

| August | ₹42.6 – ₹49.1 |

| September | ₹43.2 – ₹47.5 |

| October | ₹41.2 – ₹48.5 |

| November | ₹43 – ₹49.1 |

| December | ₹42.4 – ₹50 |

GTL Infra Share Price Target for 2080

Finally, these figures become highly speculative when projecting till 2080. If GTL Infra adapts itself to future technology and market demand, the stock price could rise dramatically, reaching between ₹1350 and ₹1540.

Here’s a table with the monthly projections for 2080:

| Month | Projected Range (₹) |

|---|---|

| January | ₹1350 – ₹1380 |

| February | ₹1370 – ₹1390 |

| March | ₹1380 – ₹1407 |

| April | ₹1375 – ₹1415 |

| May | ₹1385 – ₹1424 |

| June | ₹1409 – ₹1439 |

| July | ₹1408 – ₹1448 |

| August | ₹1416 – ₹1459 |

| September | ₹1428 – ₹1478 |

| October | ₹1485 – ₹1498 |

| November | ₹1491 – ₹1517 |

| December | ₹1512 – ₹1540 |

Sun Pharma Share Price Target From 2024 to 2035

Tata Power Share Price Prediction for 2023, 2024, 2025, 2030, and 2040

LIC Share Price Target 2023, 2024, 2025, 2027, 2030

Utkarsh Small Finance Bank Share Price Target 2024, 2025, 2026, 2027, 2030

Should You Invest?

Currently, GTL Infra is facing huge debt and financial challenges, making it a risky investment. However, if the company manages to take advantage of future technological advancements and improve its financial health, it can deliver substantial returns in the long run. Investors should keep a close eye on market developments and expert forecasts before making investment decisions.

For constant updates and information, you can join our WhatsApp or Telegram channel for the latest information on GTL Infra and other market trends.

Conclusion

GTL Infra’s future share price is closely linked to its ability to tackle industry challenges and take advantage of new opportunities. While short-term predictions suggest a cautious outlook, long-term prospects depend on how well the company adapts to emerging technologies and market trends.

FAQs

-

What factors influence GTL Infra’s share price?

Factors such as economic conditions, industry trends, company performance, and investor sentiment influence GTL Infra’s share price.

-

How often should investors check share price targets?

Investors should regularly monitor share price targets, especially around significant company events or market changes.

-

What are the risks of investing in GTL Infra?

Risks include market volatility, economic downturns, and company-specific challenges.

-

Where can I find more detailed financial reports for GTL Infra?

Detailed financial reports can be found on the company’s official website or financial news platforms.

-

How can market trends impact share price predictions?

Market trends can influence investor sentiment and expectations, impacting share price predictions.

-

How can I analyze GTL Infra’s financial health?

To analyze GTL Infra’s financial health, review its income statements, balance sheets, and cash flow statements. Key metrics to focus on include revenue growth, profit margins, debt levels, and cash flow.

-

What are the main drivers of GTL Infra’s share price?

The main drivers of GTL Infra’s share price include overall market conditions, company performance, industry trends, economic factors, and investor sentiment.

-

How does GTL Infra’s business model impact its share price?

GTL Infra’s business model, which includes telecom towers, fiber networks, and energy infrastructure, impacts its share price by affecting its revenue streams and growth potential. A strong, diversified business model can lead to higher investor confidence and a more stable share price.

-

What role do macroeconomic factors play in GTL Infra’s share price?

Macroeconomic factors such as inflation, interest rates, and economic growth influence GTL Infra’s share price by affecting overall market conditions and investor behavior. For instance, higher interest rates might increase borrowing costs, impacting profitability.

-

how can I stay updated on GTL Infra’s performance?

To stay updated on GTL Infra’s performance, regularly check its financial reports, press releases, and news articles. Following analyst recommendations and market updates can also provide valuable insights.